pinellas county sales tax rate 2019

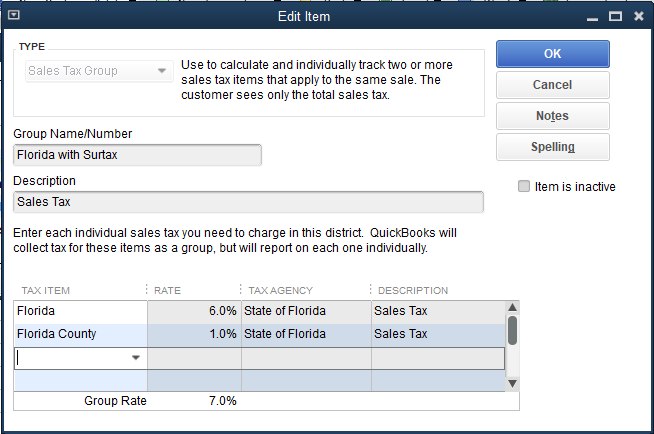

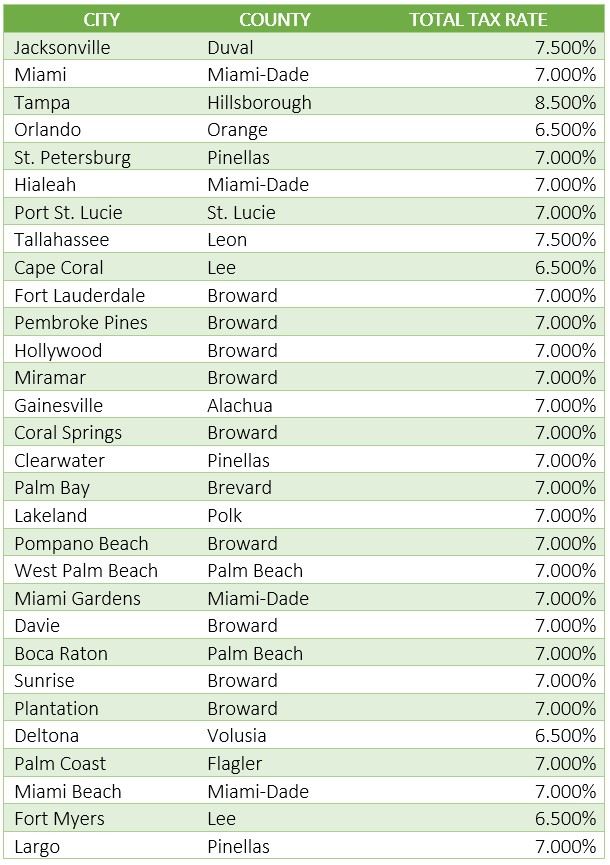

The Pinellas County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Pinellas County local sales taxesThe local sales tax consists of a 100 county sales. The Hillsborough county and Tampa sales tax rate is 75.

Get You Refund Florida Income Taxes Free Tax Calculator 2019

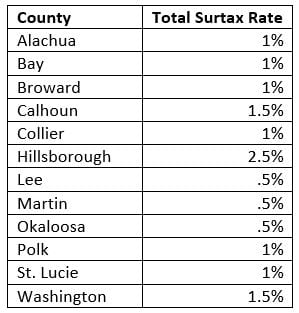

However there are some counties that do not impose surtax.

. 400 South Fort Harrison Avenue. 05 January 1 2019 December 31 2030 5 July 1 2005 100 Living and Sleeping Accommodations 70 All Other Taxable Transactions 05 January 1 2017 - December 31. 60 to County Sales Tax Pinellas County charges a 10 percent Local Discretionary Sales Surtax specifically the Local Government Infrastructure Sales Surtax more commonly referred.

Under Florida state law the Florida Department of Revenue collects 6 sales tax on 28000 which is the advertised full purchase price of 30000 minus the 500 dealer. Update Address with the Property Appraiser. That includes the FL sales tax rate of 6 and the countys discretionary sales tax rate of 15.

EBills will be sent Nov. The pinellas county sales tax is collected by the merchant on all qualifying sales made within pinellas county The current total local sales tax rate in pinellas county fl is. Accordingly the sales tax rate for the Florida counties in which FIU has taxable activities is.

The Pinellas County sales tax rate is. The 2018 United States Supreme Court decision in South Dakota v. The 6 state sales tax will be collected on the purchase price less any trade amount or previous sales tax paid in a state.

05 lower than the maximum sales tax in FL. The 7 sales tax rate in Pinellas Park consists of 6 Florida state sales tax and 1 Pinellas County sales tax. There is no applicable city.

June 4 2019 329 PM. 3 rows Sales Tax Breakdown. The discretionary sales surtax rate depends on the county where rates currently range from 5 to 15.

The Florida state sales tax rate is currently. Broward County 70 due to. The Pinellas County sales tax rate is.

Yearly median tax in Pinellas County The median property tax in Pinellas County Florida is 1699 per year for a home worth the median. Property Taxes in Pinellas County. Dont forget - pay in November for a 4 discount.

The Pinellas County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Pinellas County local sales taxesThe local sales tax consists of a 100. 2022 property tax bills will be mailed Oct. The additional Tampa sales tax.

Miami-Dade County 70 due to the additional 10 surtax.

Changes Ahead The 2019 Sales Tax Rates Are Out James Moore

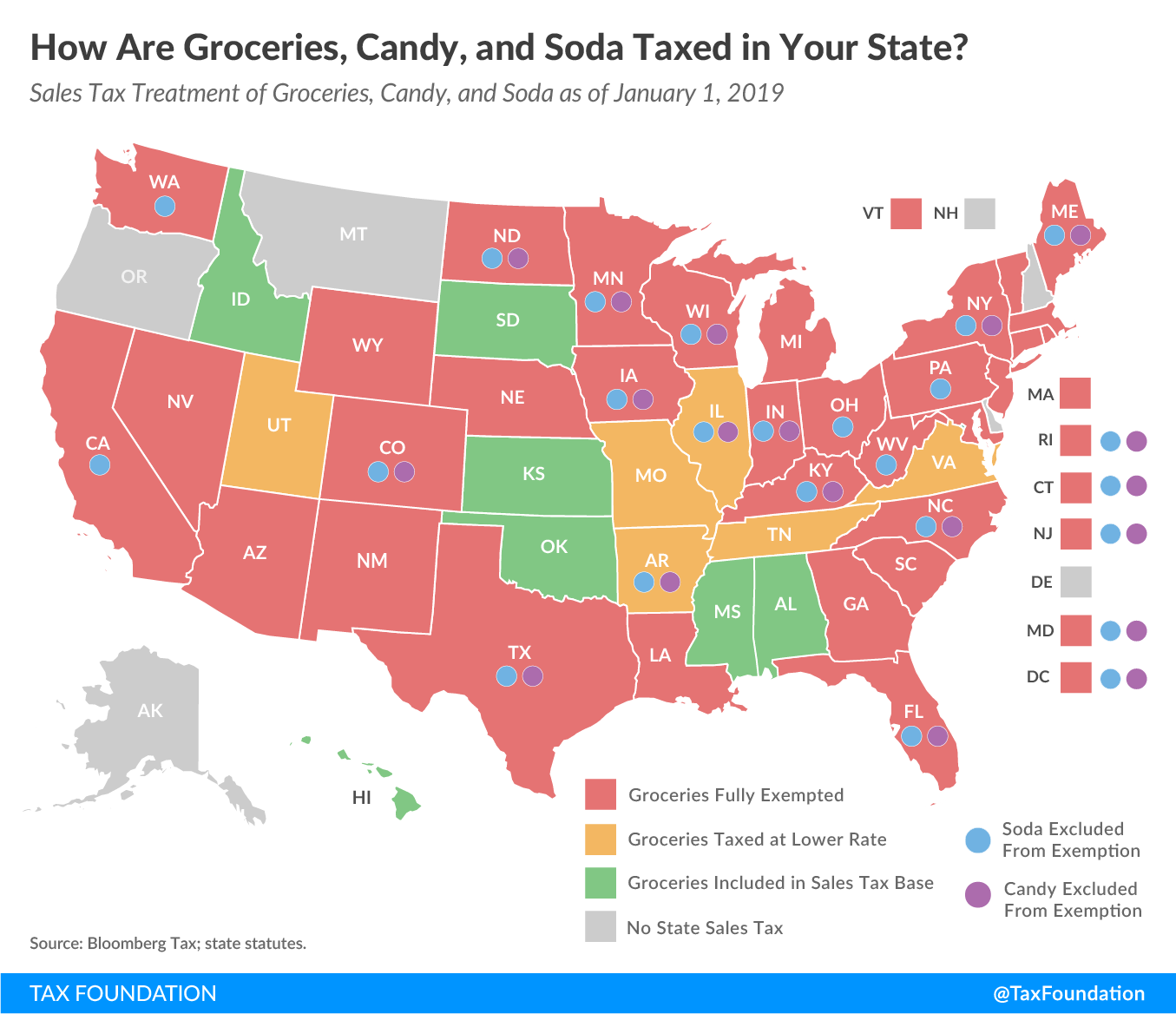

How Are Groceries Candy And Soda Taxed In Your State

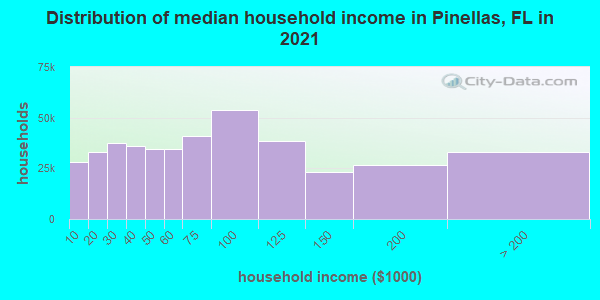

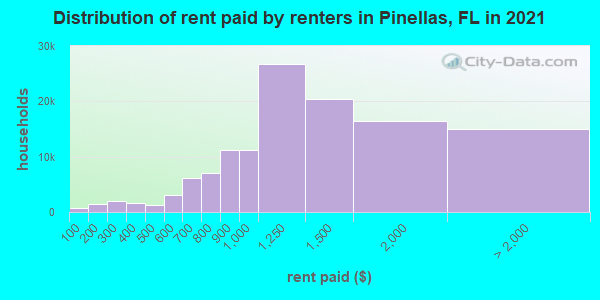

Pinellas County Florida Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

2022 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

Florida Sales Tax Rate On Commercial Rent 2020

2022 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

Are You Able To Set Up Discretionary Sales Tax By County In Florida This Tax Is Only On The First 5000 Of The Item And Is In Addition To The 6 State

U S Sales Tax Setup For Business Central

Tangible Personal Property State Tangible Personal Property Taxes

Are You Able To Set Up Discretionary Sales Tax By County In Florida This Tax Is Only On The First 5000 Of The Item And Is In Addition To The 6 State

Florida Dept Of Revenue Property Tax Data Portal

U S Sales Tax Setup For Business Central

Florida Sales Tax Guide For Businesses

2022 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

In Florida 99 Of Companies Pay No Corporate Income Tax

Florida S 50 Largest Cities And Towns Ranked For Local Taxes Kiplinger